- Procurement Strategy

- Procurement Management

- Procurement Transformation

- Strategic Procurement & Category Management

- Operational Procurement

- E-Procurement

Strategic procurement & category management: Effectively reduce costs & increase EBITDA

What if, along the entire procurement chain in your company, significant procurement savings and sustainable added value were possible today? In 9 out of 10 companies, including the ones with a functioning purchasing department, further significant procurement savings and added value can be realised through optimisation of strategic sourcing processes. Moreover, reviewing and implementing a professional sourcing methodology can drive long term sustainable value. These bespoke strategic sourcing process is also suitable for enacting quick and comprehensive changes to your supplier relationships across the board.

In this section, we address the following questions, among others:

- Why invest resources in strategic procurement and category management?

- What is the methodology for strategic procurement and category management?

- What are the typical pitfalls and challenges to be aware of?

In addition, we give practical advice, discuss approaches to solutions, and provide an outlook on how you can continue to make a decisive value contribution to your company's success with strategic procurement and category management.

Why invest resources in strategic procurement and category management?

It pays off! Still underestimated by many decision makers and procurement managers, with the right methodologies and skills, strategic procurement of a category can deliver competitive and lasting benefits. Collaboration with suppliers is a constant source of new opportunities not only because of progress and change in your business but also because of progress and change in your existing partners and the marketplace. And this is precisely why you work with suppliers. You want to be flexible and benefit from the expertise of the best supplier for your requirements. So, if something changes in that supply due to competition, technology, or some other influencing factor, you should re-examine your collaboration with the supply base and strategically evaluate alternatives to optimise your own position.

In our experience, that the opportunities resulting from good strategic procurement and category management are almost always significantly higher than the expectations of buyers and management. This underestimation often means that too few initiatives and resources are used for strategic category procurement and so the opportunities are not identified and realised.

In addition to savings, strategic category procurement secures capacity and quality. Contractually, it ensures quality, supply, and it manages risk to margin. This is important because supply bottlenecks, quality shortfalls and unexpected price increases can lead to large losses.

These are all pitfalls that can be successfully navigated through strategic procurement and category management.

Definition and tasks within strategic procurement & category management

Strategic category procurement – also called category management – refers to the process of identifying, realising, and sustainably embedding optimisation measures and savings on a category-by-category basis. The process is data-driven and fact-based and involves in-depth enrichment and analysis of internal and externally collected data from interviews and benchmarks in order to find the most suitable strategy and the most effective negotiation approach.

Categories differ in terms of their category strategy, the resources invested, and the resulting benefits for the company. Depending on the objectives, a strategic category procurement initiative optimises one or more of the dimensions of price, quality, and availability of a product, material, or service to be purchased.

Procurement without category management and strategic sourcing processes would only carry out operational procurement. Conditions, specifications, and cost and quality-influencing purchasing behavior would not be optimised and adapted in line with the constantly changing procurement markets.

Accordingly, the central tasks of category management include:

- Development of the category strategy (how the targets are to be achieved)

- Identification and suitability check of current and alternative suppliers as well as general market observation and analysis

- TCO cost analysis and structuring of pricing models, contracts, supplier collaboration processes etc.

- Execution of tenders, supplier negotiations, and supplier workshops

- Supplier selection, contract negotiation, and contract implementation (source to contract)

- Category and supplier management

The individual categories are managed by strategic buyers or category managers, who bear responsibility for their specific category over time. The tasks of strategic procurement are cyclical.

At the beginning of the cycle, opportunities regarding procurement savings, quality, and availability are identified. These are then formulated in a category strategy and are realised in a competitive tender or in partnership with suppliers. The subsequent implementation embeds the agreed conditions and suppliers in the company and slowly transitions to continuous supplier management until the end of the cycle is reached and a new cycle begins.

How do you go about strategic category procurement? Is there a fixed process?

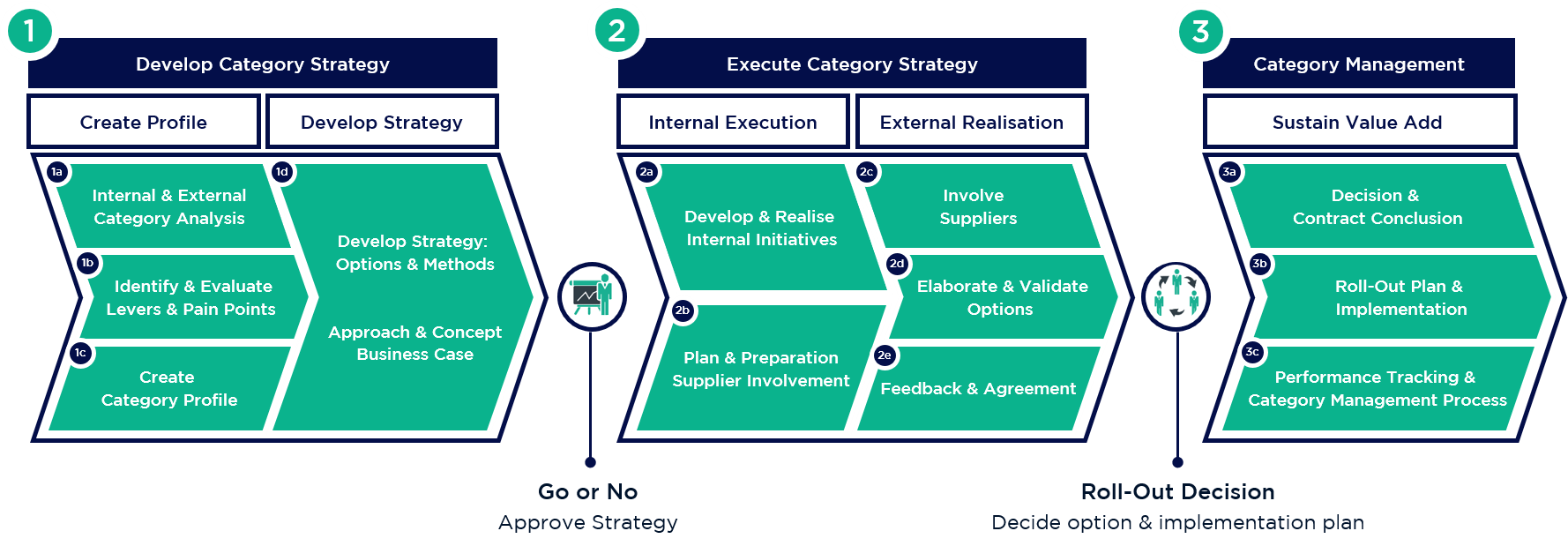

The OCM best practice methodology in category management is a 3-step procurement process, and it has proven itself an effective guide and means of orientation regardless of the category. The project management and reporting of the category is facilitated within the methodology, and the methods and steps are easy to communicate. In the following section, we first describe the general procedure before later discussing more specific procedures for different types of category.

1. Step: Develop category strategy

The first step is to develop a profile of the category in order to identify the current opportunities and risks and a standard baseline. Through internal analysis, a detailed spend profile is created, procurement and supply chain processes are mapped out, product or service specifications are determined, and key stakeholders are identified. Through external analysis, the market and both the incumbent and non-incumbent suppliers are analysed. This helps the procurement team understand and classify market dynamics and developments and the position of the company in the supply market.

Based on the information obtained and interviews conducted with the stakeholders, the next step is to identify and evaluate pain points and procurement levers. The opportunities identified in this process form the basis of the subsequent category strategy. At OCM, we distinguish between internal or demand-side levers, which improve the negotiating position with suppliers or improve product specifications and internal processes, and external or supply-side levers, which create opportunities through collaboration with suppliers. OCM works with 16 procurement levers. Each lever relates to various methods and techniques for considering procurement as a whole and maximising the added value for the company.

Based on the pain points, the identified procurement levers, and the internal and external analysis of the category, the category profile can be created. The profile is the basis for the development of the category strategy. Through the deduction and hypothesis-driven validation of all procurement opportunities, a procurement strategy is developed. The collected data and analyses are all taken into account in this decision-making process, and are also critical in the evaluation of the strategy regarding its added value and the effort required for implementation.

In category procurement, a professional category strategy distinguishes poor and mediocre from best-in-class added value. Most companies make the mistake of using the same approaches over and over again or of proceeding without a real strategy – the result is inflated costs and unexploited opportunities with suppliers.

2. Step: Execute category strategy

The second step involves the realisation of the strategy. As already mentioned, OCM pursues the approach of first creating an optimal start point for supplier discussions by developing and using internal levers. Regardless of whether one is in a situation of competition, partnership, or experiencing a procurement shortage, managing your own requirements and demand through utilising internal levers always improves your position in supplier discussions.

In addition to the use of the internal levers, it is necessary to prepare the supply base for the upcoming discussions. Preparation for tenders in the case of competition or workshops to intensify a partnership are essential in order to convincingly convey and ultimately realise the desired outcome in the supplier discussions.

The use of the external levers takes place by extensively involving the suppliers regardless of whether it is a partnership or competition-based approach. The options are determined and validated and subsequently negotiated and discussed before an agreement is reached.

The individual supplier discussions sometimes require a bespoke strategy. Here, it is both a matter of using the levers developed in fact-based discussions and of being able to assess and make use of the remaining uncertainties that accompany every negotiation.

3. Step: Category management

In the final phase, category management, the aim is to embed the negotiation results, jointly agreed measures, and added value in the company. In addition to a successful conclusion of the contract negotiations through to signature, this means the implementation of the contractual conditions in the organisation. Prices and quantity agreements must be made available to the purchase-to-pay (P2P) and invoice verification systems. New suppliers and their information must be input into the supplier management system. All affected departments must be informed of the changes, and new internal measures and conditions must be checked at regular intervals to ensure compliance and the realisation of the calculated benefits.

In addition, suitable processes and the assignment of responsibilities are required for measuring and controlling the category along the category management cycle.

Is the procedure the same for all categories? Is there anything we should pay particular attention to?

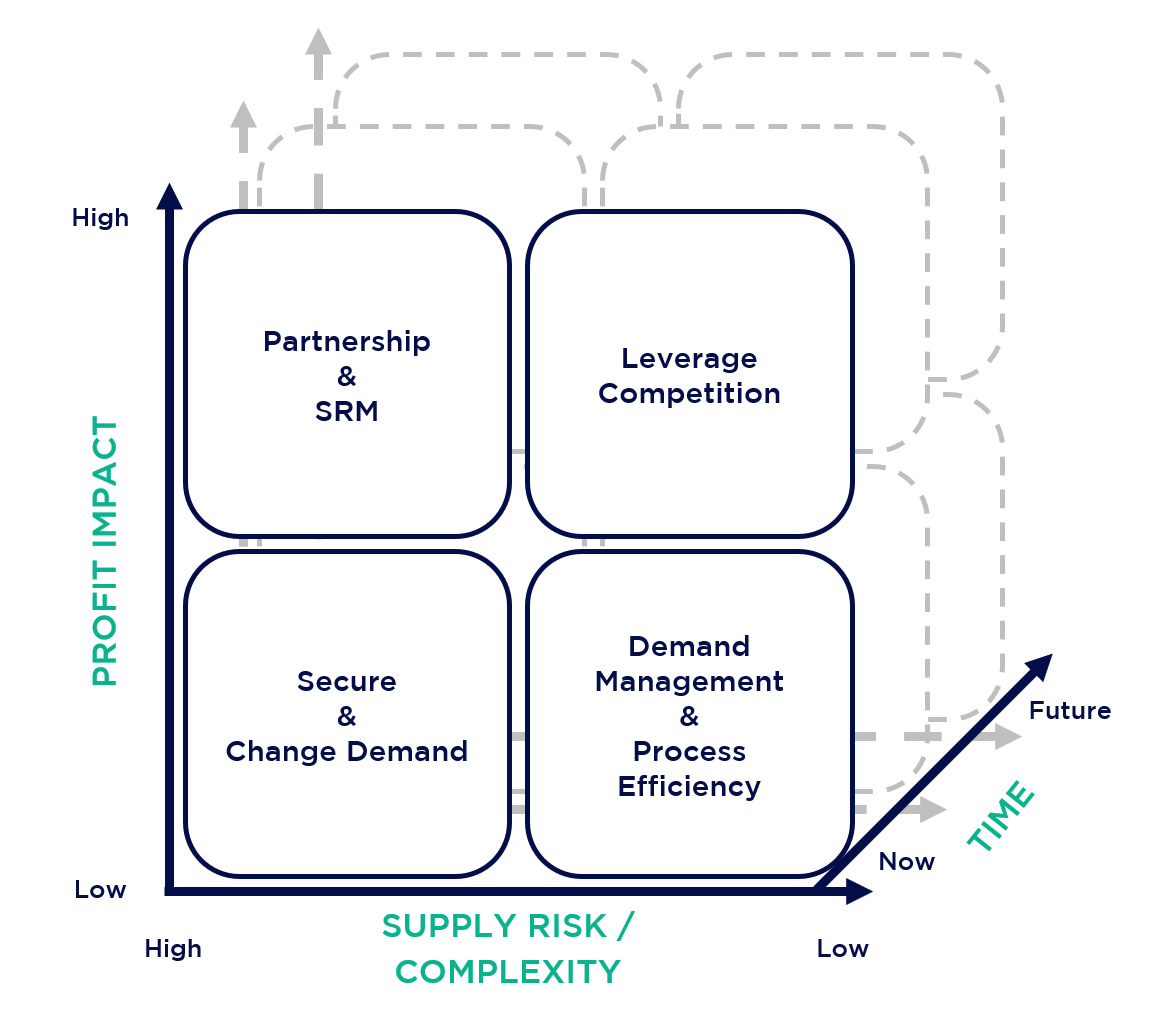

Given that categories differ in terms of their influence on profitability and their procurement risk or complexity, on the one hand the individual strategy should be adapted accordingly and on the other hand the time invested in this adaptation should remain appropriate. The profitability/complexity dimensions can be used to infer four possible guiding strategies and the categories can be classified as such.

The matrix helps to classify a category as it stands, but it is also possible to change the positioning of a category within the matrix over time through use of a suitable strategy.

Experience shows there is no one standard approach to optimise a procurement category; good procurement needs a strategy that works for each individual situation. Nevertheless, guiding strategies can be described for each segment of the matrix, and they are helpful for determining the strategic alignment and classification of a category.

Below, we describe some typical criteria and give examples on the basis of which the classification can be made and a strategy can be developed.

A-Category: Partnership & SRM

These often-strategic goods and services are characterised by having a high impact on profits as well as high complexity or high supply risk.

Fundamental raw materials in the pharmaceutical industry, engines in the automotive industry, or turbines for generators are examples of A-Categories. Often, they are or can only be procured from one supplier, creating a dependency between the company and the supplier. The dependency can become an advantage or disadvantage depending on how the balance of power is distributed between the parties and to what extent cooperation is in the interest of each party. The major advantages of dependency can be joint investment in collaboration, often creating a win-win situation and thus increasing the overall value for both partners. However, depending on the strategy, it may also make sense to exit the dependent set-up by forging relationships with new, alternative suppliers or adjusting the demand so that several suppliers can meet it, creating a basis for competition.

A-Categories are thus characterised by high earnings impact and high consequence and often require in-depth analyses and an integrative approach in the strategic sourcing process. The right procurement strategy for these categories can be decisive for competitiveness and essential to the survival of the entire company.

B-Category: Leveraging competition

Goods and products from this quadrant are characterised by competition and supplier alternatives on the supply side, i.e. the supply risk is relatively low, and, in addition, the goods and products make a decisive contribution to the company's results.

In this segment, there are many opportunities and incentives for negotiations and tenders, as high absolute savings can be achieved even through small percentage improvements in price conditions. The more competition there is in the market, the more aggressively the negotiating position can be played out and thus supplier margins reduced.

With categories in this segment, attempts are often made to further increase the leverage for supplier negotiations from the demand side, generate additional competition, and then achieve the best price on the market from a strong negotiating position. Alternatively, it can make sense to develop a strategic partnership with one or a few suppliers if this brings in further added value.

Most large-volume indirect categories and commodities and products of the direct categories are found in this segment.

C-Category: Demand management & process efficiency

The goods and services of these procurement categories are characterised by high standardisation and are often of low consequence to the success of the company. Goals for the procurement of categories in this segment are to ensure inventory and the highest possible sourcing process efficiency. This is not synonymous with neglect. Less stringent specifications and the employment of tools for the control of demand and efficient procurement frequently permit high absolute savings through small relative price improvements.

In the procurement process, the most efficient levers must be formulated and implemented in a strategy. In addition to rapid sourcing methods, self-sourcing tools are particularly recommended. The challenges lie in choosing the right approach as well as selecting the appropriate software tools and implementing them within the company.

Conclusion: Minimum requirements for price, availability, and quality are to be met with a low expenditure of resources. Efficiency in the procurement process is the focus of optimisation.

D-Category: Securing procurement & changing demand

These materials and commodities have a moderate impact on the company's bottom line but are characterised by their high risk to the company's security of supply. Examples include: inexpensive but special screws in engine construction; small & low-priced quantities of an ingredient from a supplier qualified by a patent; or seasonal and strongly weather-dependent raw materials.

For these categories, the supplier typically has a strong negotiating position. As a guiding strategy, it is advisable for procurement to accept this dependency and instead reduce any risks (for example, by keeping a high stock of the materials) or to lessen dependency by changing its own demand in order to open up to the market.

In practice: pitfalls, typical challenges, and the approach to finding solutions

There are numerous challenges and pitfalls in the application of category management. In the following sections, we highlight a few typical examples and outline possible solutions.

In many cases, conditions and outcomes in procurement are stagnating. Procurement processes and the approach to sourcing have become routine and some suppliers are so close to the company that an invitation to the annual Christmas party might be considered. When asked about optimisation opportunities, procurement and corporate management often get the answer that optimal procurement conditions have been reached and therefore no further improvements are possible – after all, things are going well.

This is a scenario that should make procurement leaders and management sit up and take notice. Close supplier relationships can be, but are not necessarily, a sign of good supplier management. Established methods and sourcing processes can be, but are not necessarily, suitable for current market conditions and the company’s situation. A sign of good category management is to be aware of one's own position in the market at all times, to vary methods and techniques, and to constantly question and challenge established suppliers. Many procurement organisations rely on the assessment of category managers; after all, they are naturally closest to the subject. However, whether each category manager regularly questions themselves and fundamentally investigates opportunities is in many cases an unasked question, which can cost companies dearly.

In order to identify the existing opportunities within our clients and to evaluate the status quo, we create a light-touch version of the category profile. In addition to collecting and evaluating spend data and processes, we try to identify and assess initial pain points and strategic procurement levers.

Furthermore, we collect historical information from past procurement initiatives as well as the current internal procurement conditions in stakeholder interviews. We also collect external market information and use benchmarks.

Frequently used methods in the Opportunity Assessment are:

- Workshops with category managers for hypothesis-driven development of procurement levers.

- Retrospective evaluation of past initiatives

- Evaluation of current market conditions through benchmarks and market developments

- Examination of introduced methods and techniques

- Interrogation of lived processes in order to identify possible process improvement opportunities

- Analysis of strategic options of the category

- Rapid market tests to see what prices are available on the market

As a result, in addition to an evaluation of the category management status quo and the derived measures for improvement, one obtains an assessment of the realistic procurement opportunities.

Does your procurement department "put the plan into action"? Do the actual implementation activities differ across different categories and do your buyers have the supporting methods and tools at their disposal? The procurement strategy is in place, the organisation is capable of leveraging the opportunities, and yet purchasing departments often miss out on procurement opportunities during the implementation of the overarching category strategy.

This is a typical problem for many companies. In most cases, there is a lack of communication of the process, a lack of clear methodology as a project framework and communication tool, and sometimes simply a lack of monitoring and management of the adherence to and implementation of the category strategy. The best strategy is pointless if it is not implemented at the category level.

The overarching category strategy defined in the procurement strategy defines general work steps, methods, and measures for each ABCD category in order to achieve the best procurement outcome with the given resources. In category procurement, the task is then to apply this to the corresponding category in each individual case. The trick for each category is to adapt the components and work steps of the methodology as well as the sourcing process itself in such a way that optimum results are achieved with the available resources. This requires two things

- an assessment and strategy to leverage identified opportunities per category

- experience in terms of content and methodology in the strategic sourcing process of categories

For the best outcomes and most efficient use of resources, we use, in addition to the classic category approach, the following methods and tools, among others: self-sourcing through e-sourcing platforms and vendor management systems, e-auctions, the concept of the “negotiation powerhouse”, joint Design-to-Cost workshops, rapid sourcing.

The greatest challenge in supplier management is the balance between the implementation of a rigorous and structured approach to supplier management and the involvement of the supplier and the affected specialist departments on both sides in the collaboration process. Another common feature of ineffective supplier management is a non-functioning performance measurement and control system. These often result in missed procurement savings or missed process or product improvements due to the negotiated terms and conditions going unrealised. Poorly integrated suppliers at the day-to-day working level and a lack of trust between parties also make communication difficult and preclude sustainable creation of added value through joint improvement of the end product.

In establishing a functioning supplier management system, we support our customers in setting up and executing processes for the regular review of procurement conditions as well as performance measurement and control systems according to contractually agreed KPIs. We also implement communication processes to improve planning and control of requirements and quality demands. By communicating planned requirements at an early stage, risk buffers can be reduced and planning certainty can be established, thus reducing costs. Targeted measures to improve supplier relations can also increase the resilience of the supply chain and improve the exchange of expertise in the search for joint technical solutions. Another step can be to involve the suppliers' material experts in product development. Joint workshops to optimise common processes and the specification of materials for the production chain can significantly and sustainably reduce procurement costs without reducing the margin.

Outlook and conclusion for strategic procurement & category management

Even with the increasing technologisation of procurement, strategic category procurement continues to be highly relevant when it comes to realising cost optimisation initiatives and securing availability at low risk. The rapid changes of procurement markets and supply chains and ever-rising customer expectations require continuous adjustment and optimisation to a company’s procurement approach and thus also the category strategies.

Through strategic category management, a company can often drastically reduce their costs while also improving quality, thus contributing to the enterprise’s overall success. Here in the day-to-day work, the opportunities created by a good strategy and procurement organisation are realised as savings and newly competitive procurement conditions.

The 3 key areas of added value through strategic category procurement are:

- Identification and realisation of savings opportunities through negotiation, supplier selection, demand management, or specification adjustments

- Value contribution in product development leading to product improvement or cost savings through successful supplier management and cost transparency

- Sustainable embedding of savings opportunities in EBITDA through active supplier management and category governance

OCM offers comprehensive support in the design and implementation of your category management through our project module Strategic Sourcing. In doing so, we ensure cost reduction, a direct impact on EBITDA, and the realisation of the category’s strategic goals.

In addition, we combine our proven approach to strategic category procurement with our product modules Training: Strategic Sourcing & Negotiation, or with the development and optimisation of your supplier management. In our wide range of procurement consulting modules, you will also find additional services to support you in optimising your costs and your procurement processes.

We would be happy to present our approach and modules in this regard and to discuss solutions based on your challenges.

Our project modules at a glance:

Procurement Consulting Modules

Procurement Opportunity Assessment

- Benchmarking & Identification of Opportunities

- Tangible Action Plan for Implementation

External Cost Transformation

- Reduce costs & stop maverick buying

- Procurement Optimisation & Zero-Based Budgeting

Procurement Process Optimisation

- Procurement processes optimisation: fast, cost-efficient, digital

- Trained and invested employees

- Improving compliance

Strategic Sourcing

- Procurement Strategy & Cost Optimisation

- Increase quality & prevent maverick buying

Procurement Strategy Design

- Sustainable max. value contribution through optimal procurement strategy

- Reduce costs, optimise procurement processes

BI Cost Reporting

- Consolidated data sources

- Meaningful live analyses

- Fact-based decision making

Procurement Operating Model

- Maximising the value-add of the procurement organisation

- Optimise, measure, & control procurement processes

Training: Strategic Sourcing & Negotiation

- Buyers trained as specialists

- Putting theory into practice and implementing with support

Interim Procurement Manager

- Rapid response: candidates within 48h

- Matching of requirements and assessment of suitability using procurement experts

- From operational buyer to CPO

Should Cost Analysis

- Should Costing als Methode der Einkaufsoptimierung

- Der Weg zu Should Cost Analyse & Should Cost Modell

Digital Procurement

- Competitive advantages in speed, scope, & significance of information

- Efficiency through automation, data integration, & process simplification

Workforce Management

- Procure-to-pay cost reduction

- Fraud prevention

Supplier Management

- Efficient Cooperation

- Performance-based Supplier Management

Insurance Optimisation

- Cost Optimization

- Bespoke Optimal Insurance Cover