6 Ways to Manage Price Volatility in Procurement

In early 2020, with the Covid-19 crisis unfolding, the price of Brent Crude Oil fell from $70 to $20 per barrel in a matter of months. By February 2022, due to global economic recovery and the Russian invasion of Ukraine, the Brent Crude Oil price had risen six-fold, to over $120 per barrel. Even within the month of March 2022, as sanctions hit Russia, the commodity price rose and fell by up to 20% multiple times within a period of weeks.

The World Bank has warned that in 2022 and beyond, the global economy will suffer ‘the largest commodity shock’ since the 1970s, with further rises in not only oil, but also natural gas, wheat, cotton... the list goes on. Experiencing the brunt of the market volatility in your company will be the procurement department. Suppliers will go out of business or call-in demanding price rises. Meanwhile, the sales department will want to hold commodity prices in order to maintain sales volumes in a disrupted market, and the board will be busy protecting against the complications caused by the underlying reasons for price volatility. Margin will suffer, or, worse, the deliverability of the goods and services themselves will be at risk.

‘The true investor welcomes volatility.’

Improperly managed, price volatility can quickly become an existential threat. But, as most stock market investors will tell you, volatility is not something to be feared. Indeed, it was Warren Buffet who said ‘The true investor welcomes volatility.’ To some extent, the same goes for the ‘true procurement department’ who, in their day-to-day operations and supplier agreements, are fully prepared for price fluctuations.

In this article, we first review the reasons for price volatility and the challenges it can cause for the procurement department. Then, we provide 6 procurement levers you can employ to handle price volatility in procurement.

What causes price volatility in procurement?

In short, anything and everything can cause market volatility. Pandemics, conflict, drought, recession: in the last few years we’ve seen it all. Perhaps when NASA spots a meteor on a collision path with Earth, we can claim to have completed the set. But in all seriousness, what exactly are the mechanics of market volatility? What is causing the volatile prices?

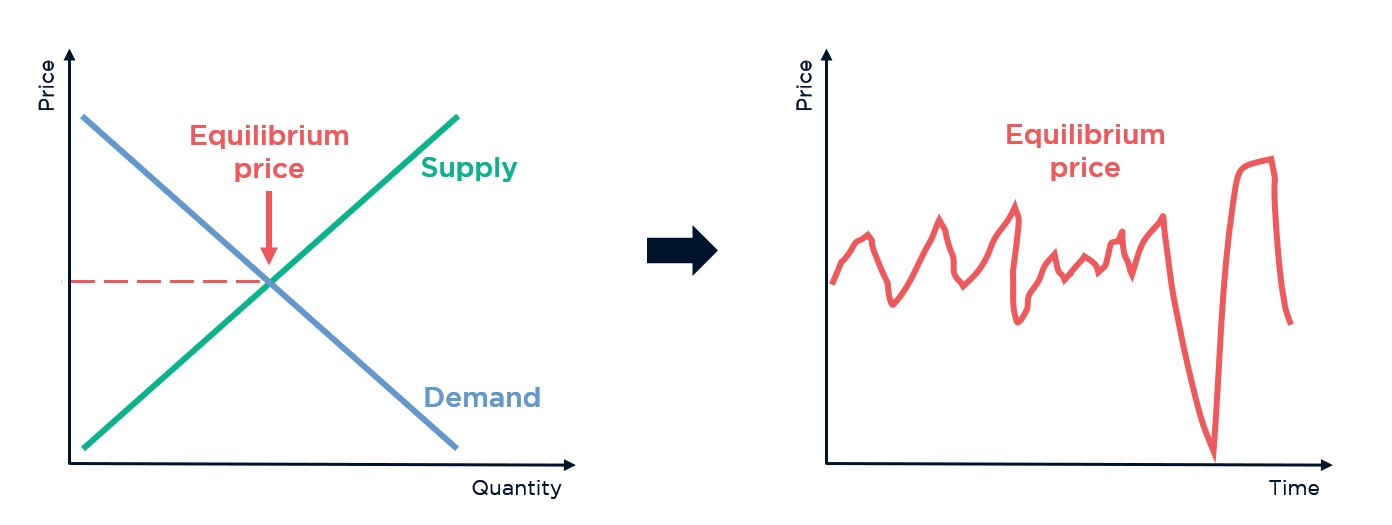

The price of a commodity is, as we all know, determined by supply and demand. Simply put, anything that affects either the supply or demand of a commodity will shift the equilibrium price. Depending on the elasticity of the supply and demand, the equilibrium price will change by a little or a lot.

In the last two years (2020-2022) we have witnessed shifts in both demand and supply, causing downward and upward pressures.

As the pandemic hit, demand for a number of commodities fell sharply: demand for travel was greatly reduced and so the price of oil fell; construction companies halted operations and so the demand and commodity prices of steel and timber declined. Downward pressures were felt by commodities across the board.

Then, as the global economy recovered, the commodity markets found themselves not only experiencing an increase in demand, but also a shortage of supply. During the downturn, the commodity producers had cut back production to reduce their fixed costs, and they could not upscale operations quickly enough. Add to this the supply chain disruptions caused by events such as the blocking of the Panama Canal and the war in Ukraine, and the supply challenges intensified. Commodity prices recovered and then rose above pre-pandemic levels.

As is often the case, price volatility originates from seemingly unique market conditions. Few could have predicted a novel corona virus and all of its subsequent variants sweeping the globe in 2020; and the invasion of Ukraine is, hopefully, an international aberration. But we can generalise such events into a number of categories that help us understand the impact of similar conditions.

- Weather & Climate: Depending on seasonal weather conditions and temperatures, the demand for fossil fuels to heat homes will change. For example, cold winters and high demand lead to high prices. Similarly, poor growing conditions due to extreme weather reduce the supply of food, leading to increased prices; excellent growing conditions can produce a bumper crop, reducing prices.

- Conflict: Disruption on the international stage will almost certainly impact supply, whether it be due to an inability to produce in conflict zones, or by the introduction of international sanctions on belligerent states, disrupting established supply channels.

- Economic downturn or recession: Reduced spending by consumers and reduced investment in e.g. infrastructure will typically lead to reduced demand and prices. The converse is true in times of economic recovery or boom.

- General supply chain disruption: From blocked trade routes to component shortages, when production or the movement of goods is disrupted, prices will generally increase.

Needless to say, each event affects the global economy in its own unique way, particularly when drilling down to the impact on individual commodities – wheat production from major food producer, Ukraine, for instance. The impact of each event should therefore be analysed on a case-by-case basis.

What are the key challenges caused by price volatility in procurement?

Typically, between 10-50% of the manufacturing cost of a product is attributable to the cost of the raw materials. Factor in how, for example, oil prices affect logistics costs and how inflation impacts workers’ wages, and it’s easy to see how market volatility impacts not only the prices procurement pay for commodities, but for any good or service.

Rising commodity prices are obviously an issue for an unprepared procurement department. Either margin will shrink or there is a decision to be made about increasing sales prices and risking customer loyalty. But equally difficult challenges are met when encountering falling prices.

For example, when commodity prices fall, but the procurement department is contractually beholden to prices agreed at a higher commodity price, the company has forgone an increase in margin or the opportunity to lower prices and gain market share. It gets worse if a competitor has agreed purchase prices that track commodity prices: the company might see its prices undercut. In such circumstances, market share ebbs away and the company can find itself in the midst of an existential crisis, the same way it might when experiencing a margin squeeze during rising commodity prices.

Furthermore, the challenges caused by market volatility are not limited to the prices paid. As explained, volatile prices and markets are often caused by supply issues, which can have the following knock-on effects:

- Missed delivery dates: Agreed delivery dates with customers are at risk when there are delays in the supply chain, causing contractual issues or missed business opportunities.

- Competition with more profitable industries: When commodities are in short supply, more profitable industries are able to afford increased commodity costs. Less profitable industries suffer disproportionately.

- The rise of low-cost competitors: When belts tighten in the face of rising commodity prices, the importance of price in the procurement decision-making process – and the retail customer’s decision-making process – increases. If a company offers a premium product or a service with benefits that are difficult to quantify financially, it may be elbowed out by the low-cost competition.

- Uncertainty in production planning: For production involving volatile commodities, planners must work in a degree of risk. Over-planning production leads to resource downtime and unnecessary cost, while under-planning leads to missed opportunities and costly inventory.

So, among great supply and price uncertainty, how does a company set itself up for success?

How to manage price volatility in procurement

Price volatility doesn’t have to be all doom and gloom for the procurement department. In fact, when handled effectively, it can create an advantage over unprepared competitors.

Here, we present 6 procurement levers that you can employ to manage market volatility in your procurement department:

The first step towards understanding the impact of market volatility on your procurement activities is to understand the proportion of the purchase price that is attributable to the commodity price. When buying sheet steel, for example, this proportion is likely to be high, with a relatively small proportion of the price constituting logistics and management costs. When purchasing fabricated steel product, the commodity proportion will be smaller, as the supplier encounters additional manufacturing, design and storage costs.

Often, suppliers are reluctant to divulge such information in order to hide margin within a single purchase price. A competitive tender process can help to deconstruct the purchase price. This information can then be used to inform risk management, monitoring and control processes, and to form measurable KPIs calculated from reliable data sources agreed between the parties.

This step, while useful in and of itself, also forms the basis of the majority of the subsequent procurement levers. In the land of price volatility, data is king...

To entirely devolve the company of volatility risk, commodity costs can be passed through from the supplier to the customer. Any such mechanism should be agreed in both the contracts negotiated with suppliers and the contracts negotiated by the sales department with the customer.

Whether this is appropriate in practice depends on the customer. Some will be happy to shoulder the risk, while the risk-averse may prefer greater certainty and fixed prices. In short, it is a matter of both internal and external policy, and one that needs to be openly discussed with full data transparency.

In certain circumstances, it will be possible to change the raw materials used to manufacture a product. Although this might sound relatively simple, there are a number of risks and hurdles to overcome:

- Design: Any changes in material need to be signed off by the product design team to ensure they a) work b) do not impact other aspects of the product, particularly in the long term, and c) meet all regulatory guidelines. Needless to say, when testing and regulations are involved, this process can take months, even years, exceeding the time horizon of price volatility. So before embarking on any such changes, a full project timeline should be drawn up.

- Contractual agreements: Contracts with the raw material supplier may include guaranteed volumes for a set timeframe – changing will therefore require a negotiation and potentially exit costs. Likewise, sales contracts may stipulate the use of certain materials so any change must be agreed with the customer.

- Replacement volatility: Needless to say, it would be foolish to change from one raw material to another, only to find that, once the change has been made, the price of the replacement has risen above the original. A change should only be made if the replacement is of genuinely lower cost or is of a preferable volatility risk.

Before making any change, a full cost-benefit analysis should be performed, whereby the benefit is projected over a number of years, taking into account market volatility using scenario analysis.

Collaboration or competition? The age-old procurement question is particularly applicable when dealing with volatile markets.

A collaborative relationship with a single supplier can be used to open up the accounting books, leading to increased understanding and transparency. The effects of price volatility can then be addressed together, whether that be through a change in purchase price, price hedging or fixing, or by seeking innovative technical solutions, such as material substitution.

When, for whatever reason, collaboration is not possible, the competitive route is equally viable. Multiple supply sources can be used to obtain the best price possible through competition. When commodity prices are falling, trust that the suppliers will lower their sales prices in order to gain volume; when they are rising, trust that the suppliers are doing all they can to avoid losing volume to the competition. In this way, the equilibrium price can be achieved.

So what is the answer to the question? It depends on the purchasing power of your company, and the profile of the market itself. For complex products or services, a hybrid solution is also possible, by forming, for example, a procurement alliance. In such arrangements, a company contracts with a small number of large suppliers and benefits from their shared expertise in a collaborative setting along with competitive friction to ensure efficient processes and pricing.

When dealing with volatile markets, the decision to fix prices over a long period of time or operate on a ‘spot price’ basis (the market price at the time of purchase) can be a difficult one.

Fixing the price with a supplier creates certainty for the business but will lead to the supplier pricing in risk. It also opens up the possibility of paying over the odds should the price decline, with the aforementioned associated challenges. Paying spot prices reduces certainty but also decreases any priced-in risk, with the chance to ‘win’ or ‘lose’ depending on the whims of the market.

Scenario analysis can be used to determine what the financial risk to the company is in each case. This analysis should take into account the commodity prices over a specified time horizon and, where possible, the probabilities of each commodity price profile. From this, an ‘expected’ cost of each approach can be calculated.

Note, this analysis should also consider the fact that, in cases of extreme commodity price rises, fixing prices can lead to supplier bankruptcy. This would mean the company must find a new supplier and is therefore exposed to a high commodity price in a newly agreed odds, potentially having overpaid during times of lower prices. Contractual assurances can only go so far.

Exposure can also be mitigated by ensuring the same pricing approach is taken in both the procurement and sales contracts: fixed procurement contracts associated with fixed sales prices; or spot procurement contracts associated with spot sales prices (as-in cost pass-through). Aligning all contracts is no mean feat, as it depends on various suppliers’ and customers’ appetites for risk. Where the contracts don’t align, the risk must be quantitively understood and accounted for.

There is also what might be deemed a ‘hybrid’ approach: hedging. In this case, the procurement department actively engages with the commodity market on a regular basis in order to fix prices for a defined period of time. For a small procurement operation, this might involve some rudimentary forecasting and negotiation, but for a company that is highly exposed to price volatility – a large food manufacturer buying wheat, for example – it may take the form of a sophisticated trading team. It is also possible to outsource the hedging function to a specialist organisation.

SCM Leveraging is perhaps one of the most instinctive ways of addressing price volatility, after all, it has been used by farmers for centuries: when the crop is good and plentiful, store it in the barns and wait for winter.

Of course, in the modern-day supply chain, it is a little more complex, but the principles remain the same. In times of oversupply and low prices, build up and hold onto stock so it can be used in times of undersupply and high prices.

Essentially, SCM Leveraging is a method of flattening the price and comes with the same exposure as the methods mentioned above; namely, how do you know the price you are purchasing at now is the lowest possible? Furthermore, there is a cost to storing the additional stock in the form of warehousing and logistics.

That said, when properly implemented, SCM Leveraging is an effective way of mitigating price volatility. It also ensures supply continuity in times when the competition is struggling to keep up.

Price Volatility in Procurement: Conclusions and Recommendations

As ancient Greek philosopher Heraclitus once proclaimed: ‘The only constant in life is change’. Volatile prices are inevitable.

For some categories and industries, price volatility poses significant risks but, with a proactive approach, the procurement department can mitigate the risks and even turn market volatility into a competitive advantage.

Data transparency is the foundation of all price volatility initiatives; it can inform fixed or variable pricing strategies, material substitution, and collaborative vs. competitive SRM.

Needless to say, dealing with market volatility is complex and multi-faceted, and the analysis is often data-intensive and dependent on supplier cooperation. Here at OCM, we have experience in addressing price volatility in procurement. If you would like to know more about our service offerings, and how we can help you specifically, please don’t hesitate to get in touch.

Logistics optimisation & Supply Chain Consulting modules

Logistics & SCM Opportunity Assessment

- Benchmarking & maturity testing

- Identification of opportunities & action plan

Transport Partner Management

- Transport partner strategy & professionalisation

- Securing resources and resource training design

Transport Tender

- Competition, effective transport tendering, fact-based negotiation

- Transport cost reduction

Freight & Logistics Tender

- Competitive pricing, quality, and performance assurance

- Individual weight-distance matrix

Warehouse Optimisation

- Efficient warehouse logistics & layout

- Optimised processes & working capital

Logistics Cooperation

- Optimising logistics through synergies

- Finding a fair and stable collaboration model

Route Optimisation

- Distance and route reduction

- Reduce resource & logistics costs

Supply Chain Network Optimisation

- Optimise delivery times, service levels, & processes

- Reduce working capital

Inventory & Order Management

- Optimal order quantity & stock on hand

- Optimise working capital

Fleet Optimisation

- Fleet concept tailored to requirements

- Cost optimisation

Supply Chain & Logistics Strategy

- Sustainable maximum value contribution of the supply chain

- Clear objectives, concrete measures

Digital Logistics Management & Reporting

- Information advantages in speed, scope, & significance

- Efficiency through automation, data integration & process simplification

Interim Supply Chain & Logistics Manager

- Rapid response: candidates within 48h

- Matching of requirements and assessment of suitability using logistics experts

- From dispatcher to logistics manager

Short-term staff shortage? Unexpected need for action?

Learn more