Fact Sheet

- Creation of competition and independence

- Adaption of the procurement strategy to the company´s market position

- Optimisation of ordering behavior and procurement pricing strategy

Strategic procurement & cost optimisation of pharmaceutical raw materials

What made this project exceptional?

Our client, a contract manufacturer for pharmaceuticals and dietary supplements, has the vision of becoming the market leading CDMO within their industry and to offer their customers outstanding quality and service at a competitive price level.

The foundation for achieving these ambitious goals were set by the merger of several regional pharma CDMOs. Through the merger, our client could take advantage of the resulting broadened product range, increased production expertise, and a consolidated central procurement department.

In addition to production expertise, strategic procurement in particular played a decisive role in the competitiveness of the company and therefore in the achievement of its targets. Raw material procurement can often account for up to 50% of total costs in pharmaceutical manufacturing and therefore also for pharma CDMOs. As with many direct materials – though particularly in the area of pharmaceutical raw materials – the general rule applies: the more complex the specifications, production process, or supplier circumstances for a material, the more complex the requirements, the greater the savings opportunities, and the larger the pressure on strategic procurement and the entire organisation.

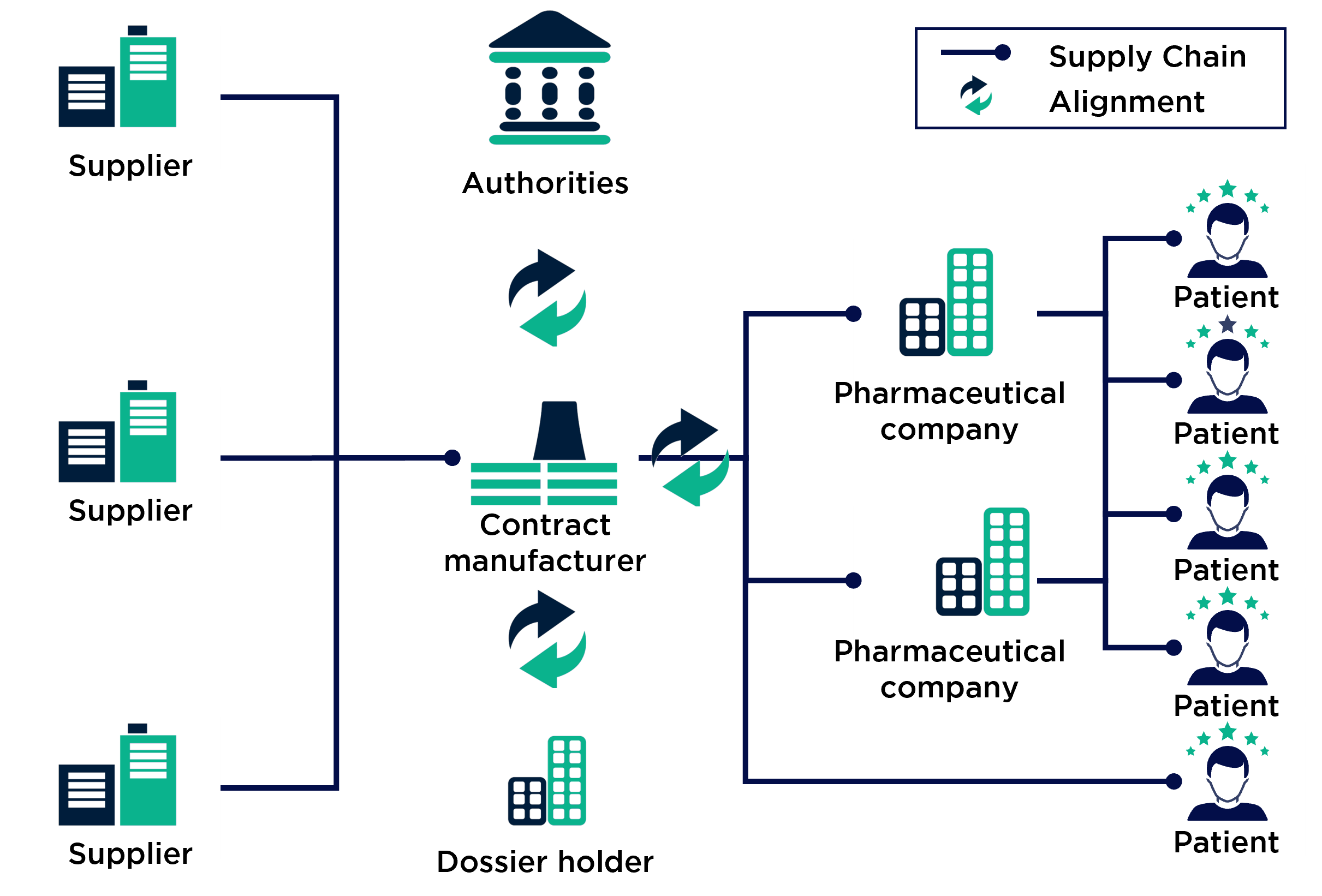

A closer look at the pharmaceutical supply chain containing a contract manufacturer illustrates the complexity and importance of the procurement exercise:

Typically, pharma CDMOs receive orders from big pharma players for their less lucrative products. In the pharmaceutical industry, this is especially true for products that have passed patent expiration or have low circulation volumes. The onset of competition or the high production costs compared to patent-protected products mean that many pharmaceutical giants outsource their products to contract manufacturers. These compete to win the orders and can distinguish themselves through cost efficiency and flexibility in production, but above all through procurement excellence. To achieve this, contract manufacturers often have to accept not only regulatory restrictions but also customer-side regulations on supplier utilisation and qualification as well as short planning periods for the quantities required.

In pharmaceutical raw material procurement in particular, the industry’s strict and internationally non-standardised regulations combined with the unique circumstances of the supply chain present a particularly challenging situation.

Additionally, in the case of our client, the integration of the individual companies and the associated changes in the organisational structure impaired the performance of procurement. Our client's strategic procurement function was severely neglected to the detriment of day-to-day business, which consisted of maintaining the supply of necessary pharmaceutical raw materials for production.

Objectives and approach of the cost optimisation project

Over a period of 8 months, we supported our client in achieving maximum savings with improved availability and at least the same if not better level of material quality.

The biggest challenges of this cost optimization project at a pharma CDMO were: to understand the multitude of restrictions as well as the 3500 different types of pharmaceutical raw materials; to achieve transparency regarding all dependencies; and to use the available resources efficiently. The ambitious objectives were largely addressed by using 3 levers:

- Cost optimisation with existing suppliers through competition

- Use and qualification of the best alternative suppliers

- Optimisation of procurement conditions and procurement behavior

With this in mind, the project was divided into 4 phases:

Testing the suitability of an alternative material is very time-consuming and resource-intensive. Consequently, it makes sense to do this only for those pharmaceutical raw materials that justify the effort through potential cost optimisation or other tangible benefits. The same applies to the creation of competition with existing service providers – this requires serious, comparable, and, above all, improved offers from competitors.

For these reasons, the materials were grouped into homogeneous pharmaceutical material categories under the following criteria:

- Material family

- Cost-differentiating characteristics

- Manufacturing methods

- Market access, price influences, & producers

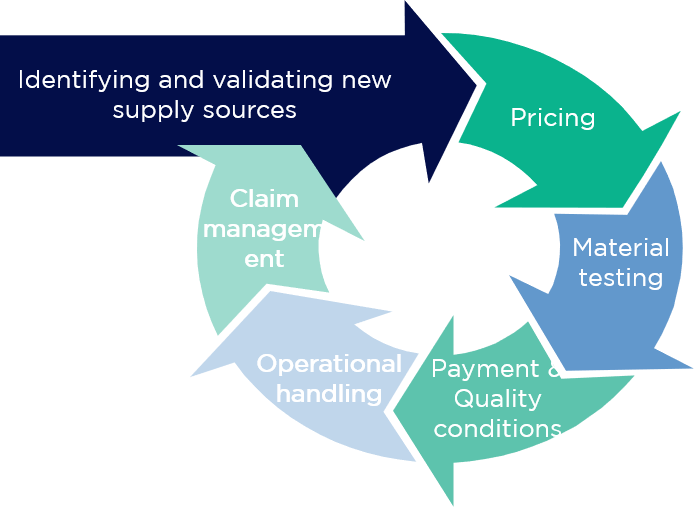

On the basis of the consolidated material groups, as well as the expected annual quantities and a general specification, quotations were requested from suppliers worldwide, along with the corresponding regulatory and technical documentation. For efficient processing and in consideration of the Asian market’s working culture, which is based on trust and individual emails, this was carried out in the form of a semi-automated email process.

This approach made it possible to request the information necessary for a detailed review and, above all, to discuss a market price level for most raw materials.

In addition to the requested prices, a cost-benefit assessment was also required in order to ensure the resources are used in the most effective way. Therefore, in the second step, the restrictions and complexity of potential material changes and negotiations were discussed internally in parallel to the price inquiries. In addition, the likelihood of switching and the prospect of a price pass-through to the patent-holding pharmaceutical companies were assessed.

Together with the results of the market price survey, a complete picture was now available to evaluate the best course of action. A material ROI calculated from the expected projected savings, the associated resources required, the influence of the respective restrictions, and the likelihood of occurrence all formed the starting point for a concrete action plan.

In the third phase, a procurement strategy and approach per material were developed and prepared for implementation.

Demand-side and supply-side levers were developed to maximise leverage for supplier negotiations. The most effective levers identified involved expanding the supplier market from local to global, changing from a mainly 1-supplier to a 2-supplier strategy, adjusting contract pricing models from fixed prices to seasonally predictable spot prices, and adjusting order quantities and supply chain operations.

3 significant strategic options were developed:

1) Trader tender:

Some raw materials, due to quantities or market conditions, did not allow for negotiating directly with the manufacturer, or these traders were required to play a necessary role in the supply chain. In these cases, a competitive trader tender was conducted. In this way, re-qualification of the manufacturer could be bypassed and the competition between several traders could be used.

2) Direct sourcing and volume commitments

Many materials could be purchased directly from manufacturers without restrictions. Through improved coordination of required annual volumes and procurement commitments, planning risks could be reduced and production capacity better utilised. In addition, margins were reduced by bypassing some intermediaries. Together with manufacturers, collaborative partnerships were improved through various initiatives and overall supply chain costs were optimised.

3) Qualification of alternatives

For some pharmaceutical raw materials, alternatives offered at the same quality but at a significantly cheaper price could be identified. In product areas that were not subject to manufacturer qualification, the alternatives could be used directly after extensive testing. In the second step, the current suppliers were negotiated with under competitive circumstances. In the case of pharmaceutical raw materials that were manufacturer-bound due to the necessary approvals, a qualification process was initiated if a change was deemed strategically relevant. This reduced procurement risk and provided an alternative source for price negotiation.

The negotiations with existing suppliers were prepared individually with the involvement of procurement and relevant supply chain managers, yielding savings of 7% p.a. on average. Trader tendering resulted in savings of 31%. Contracting alternative sources resulted in average savings of 48% which were yet to be confirmed by the qualification process. The qualification of these manufacturers and raw materials was initiated. The process to qualify the alternative source and have it approved lasted between 6 and 18 months depending on the individual material.

Conclusion and Outlook on strategic procurement of pharmaceutical raw materials

Strategic raw material procurement in the pharmaceutical industry is complex due to the many and globally varying regulations as well as changes in production techniques. The specification requirements for raw materials are extremely technical and extensive, and communication with Asian producers in particular is a challenge.

However, such challenges lead to opportunities. Many European companies and CDMOs in the pharmaceutical industry have traditionally had little experience in working together due to the high margins and concerns about quality from overseas. Companies that are able to overcome prejudices and invest more in communication and coordination with foreign companies can realise immense procurement cost optimisation and additional supply alternatives.

We would be happy to discuss with you the current circumstances, direction, potential for cost optimisation and further possibilities of your commodity procurement.

OCM is your reliable, innovative partner for customised procurement strategies and their successful implementation.

We combine our proven approach to align and optimise your procurement management with effective implementation in direct and indirect categories. In addition, we offer our expertise in supply chain management in order to optimise global supply chains. We would be happy to present our approach and modules to you or discuss concrete solutions based on your challenges.

Procurement Consulting Modules

Procurement Opportunity Assessment

- Benchmarking & Identification of Opportunities

- Tangible Action Plan for Implementation

External Cost Transformation

- Reduce costs & stop maverick buying

- Procurement Optimisation & Zero-Based Budgeting

Procurement Process Optimisation

- Procurement processes optimisation: fast, cost-efficient, digital

- Trained and invested employees

- Improving compliance

Strategic Sourcing

- Procurement Strategy & Cost Optimisation

- Increase quality & prevent maverick buying

Procurement Strategy Design

- Sustainable max. value contribution through optimal procurement strategy

- Reduce costs, optimise procurement processes

BI Cost Reporting

- Consolidated data sources

- Meaningful live analyses

- Fact-based decision making

Procurement Operating Model

- Maximising the value-add of the procurement organisation

- Optimise, measure, & control procurement processes

Training: Strategic Sourcing & Negotiation

- Buyers trained as specialists

- Putting theory into practice and implementing with support

Interim Procurement Manager

- Rapid response: candidates within 48h

- Matching of requirements and assessment of suitability using procurement experts

- From operational buyer to CPO

Should Cost Analysis

- Should Costing als Methode der Einkaufsoptimierung

- Der Weg zu Should Cost Analyse & Should Cost Modell

Digital Procurement

- Competitive advantages in speed, scope, & significance of information

- Efficiency through automation, data integration, & process simplification

Workforce Management

- Procure-to-pay cost reduction

- Fraud prevention

Supplier Management

- Efficient Cooperation

- Performance-based Supplier Management

Insurance Optimisation

- Cost Optimization

- Bespoke Optimal Insurance Cover